Reducing Churn Through Research Synthesis

Systems Thinking

Research Synthesis

Market Intelligence

Overview

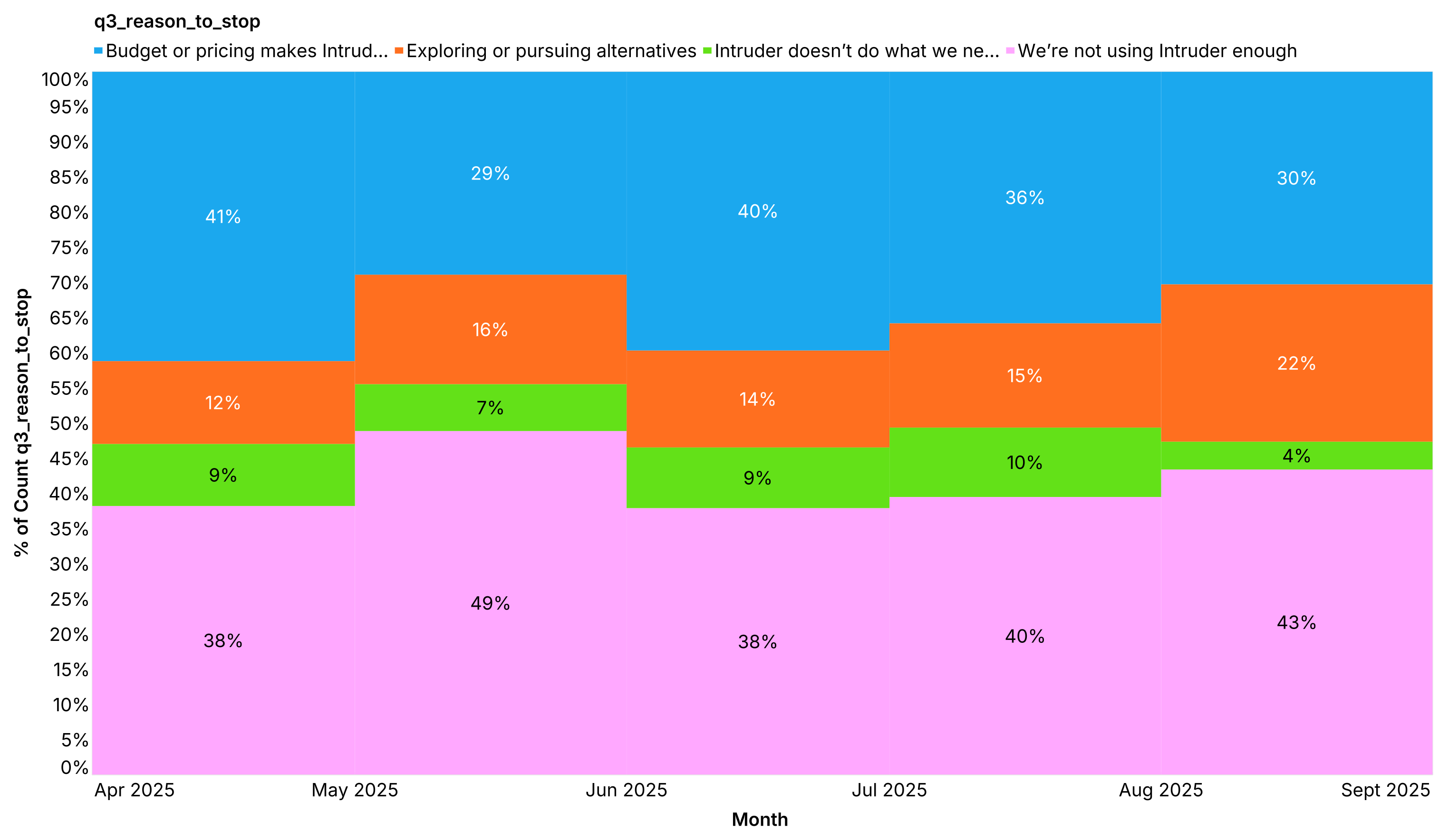

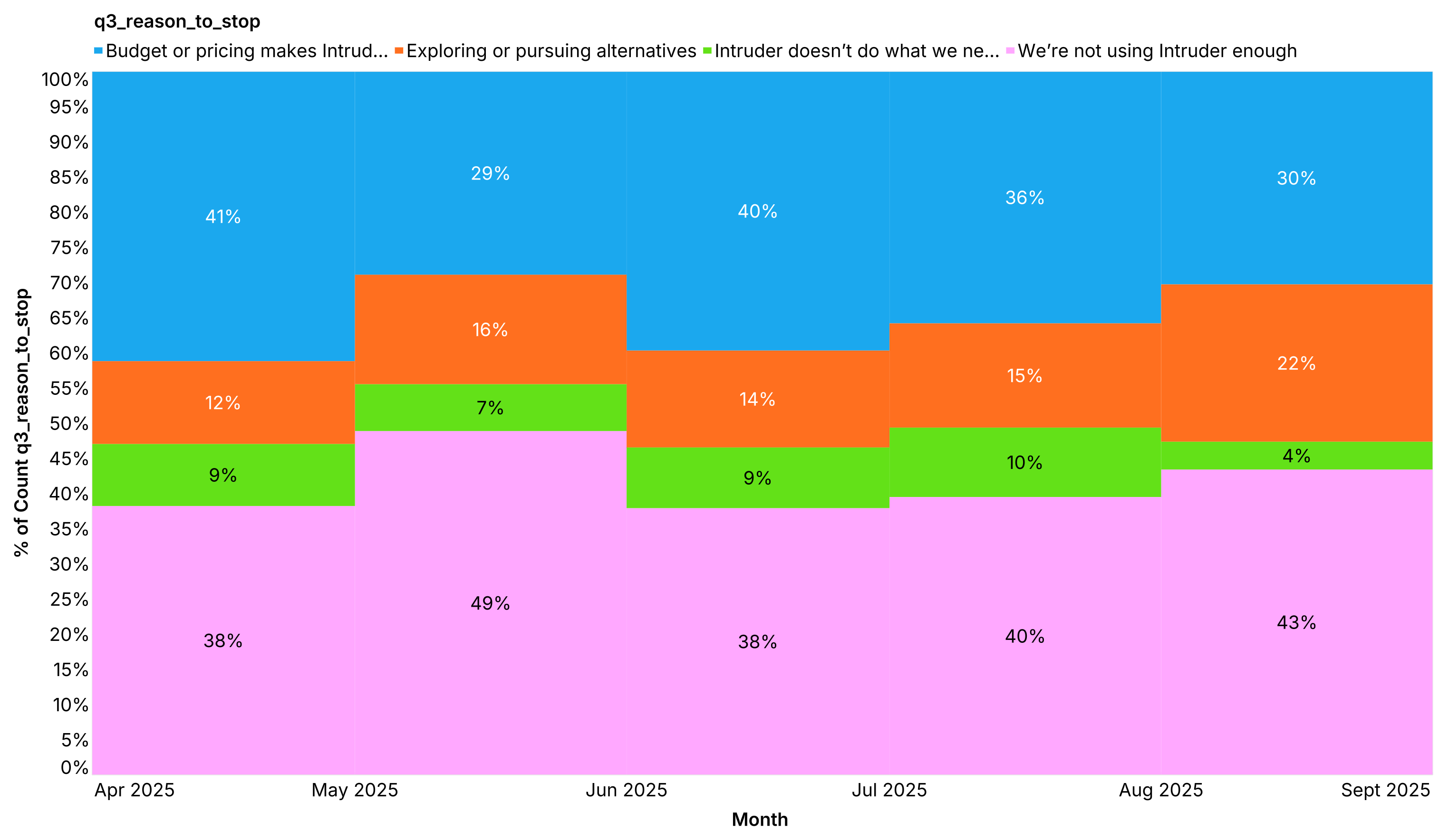

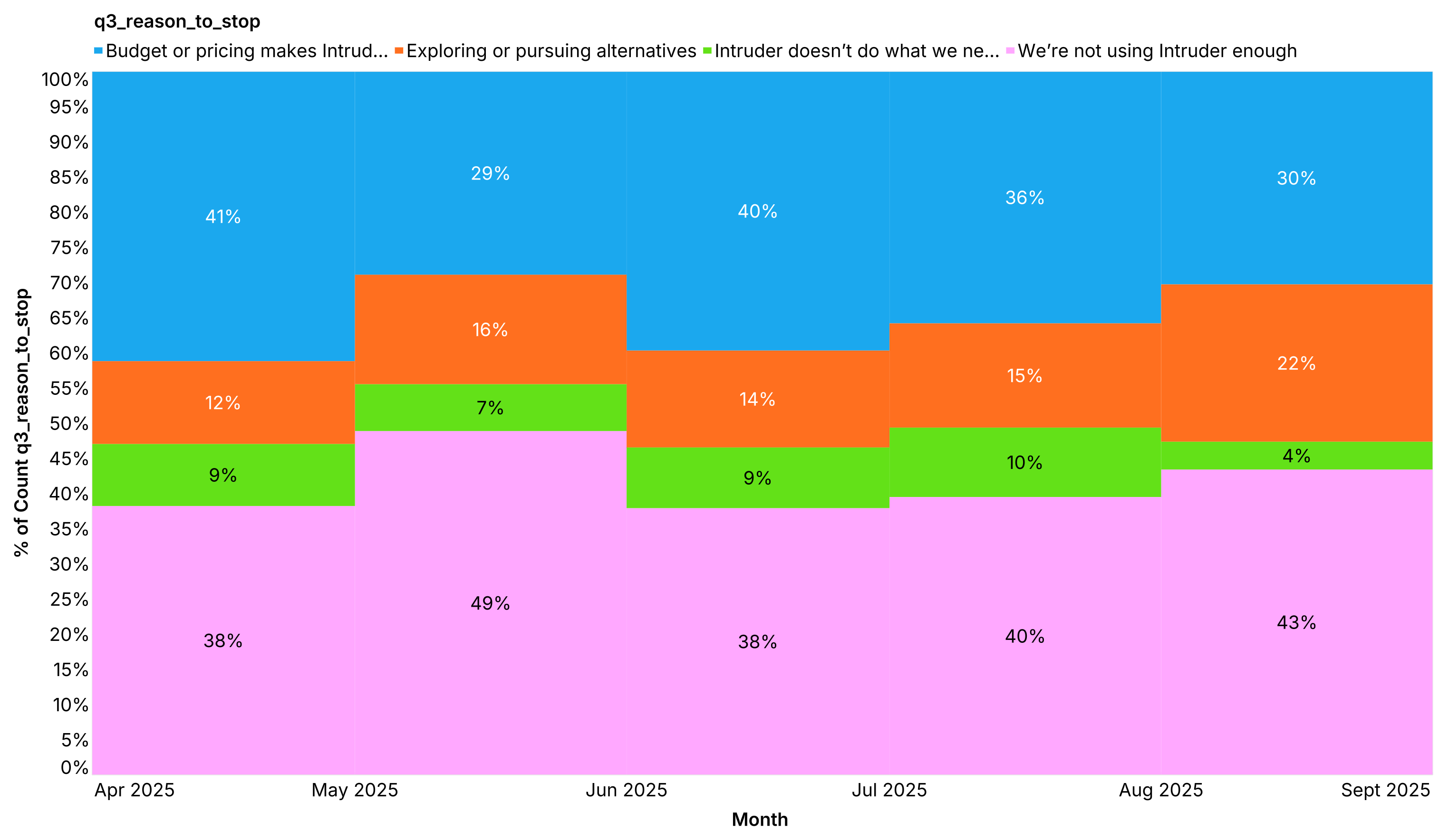

Customer churn analysis revealed our platform was misaligned with actual user needs, we built for continuous monitoring while most departing customers wanted occasional scanning.

I ran conducted quantitative and qualitative research across our most popular subscription tiers, finding three critical friction points: a value perception gap, pricing model misalignment, and feature over-engineering for simpler use cases.

The research provided strategic recommendations for usage-based pricing and market segmentation opportunities that could reduce preventable churn and capture underserved customer segments.

Involvement

Project manager

~3 Weeks (Q2 ‘25)

Figjam, Count, Dovetail, Notion

Impact

>80%

Of MRR identified via Churn Surveys as a key threat to Intruder’s annual strategic goals.

Aligned pricing with customer behaviour

Key recommendations were framed to tie customer behaviour back into the revenue model.

Repeatable Models

Established to link user research to business outcomes, embedding customer-centric thinking at the leadership level of the organisation.

Challenge

Intruder's churn rates exceeded industry benchmarks despite leadership focus on larger enterprise contracts. Our core customer base, smaller organisations representing ~80% of monthly recurring revenue, was leaving at concerning rates. Previous attempts to address churn through plan iteration hadn't worked.

Exit survey feedback suggested fundamental misalignment between our continuous monitoring product and actual customer needs.

Approach

As Product Design Manager, I scoped and led an end-to-end churn analysis initiative combining:

Research Methods

- Exit and product-market fit surveys

- JTBD and User Interviews Conducted

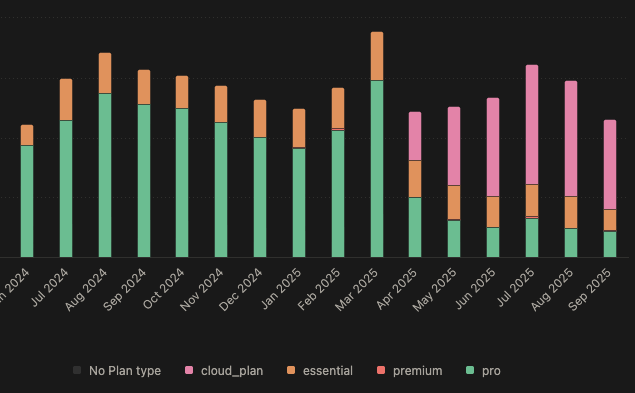

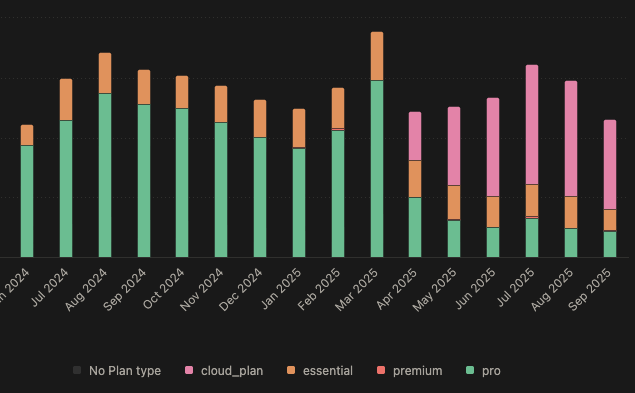

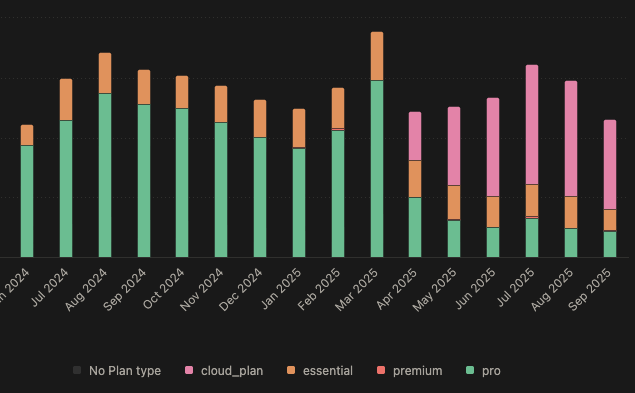

- Usage data analysis across Pro, Cloud, and Essential tiers

- Competitive landscape analysis

- Customer segmentation by lifespan, company size, target count, and vulnerabilities detected

Analysis Framework

Grouped qualitative feedback into behavioural themes, then translated findings into strategic business recommendations for leadership.

As part of the review we did a range of JTBD interviews with new customers who were relatively early in the customer lifecycle.

Key Findings

Product-Market Misalignment

~75% of those who filled in the required churn survey gave reasons like the following:

“The value was good especially compared to other typical third-party scanners that just put a human in the loop to send you a Nessus report and charge twice as much as you do. However I don't have need for continuous scanning at this moment.”

Kevin, Essential Tier Customer

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

“The 30 day delay for reassigning licences is really painful when updating a device. Particularly if a device has not been active for >30 days.”

Adrian, Pro Tier Customer

Fixed subscriptions didn't match variable usage patterns, creating administrative burden and perceived inflexibility.

Strategic Insights

Critical Business Risk

The segment experiencing these issues represented ~80% of MRR, massive opportunity cost from focusing exclusively on enterprise while neglecting core revenue base.

Competitive Context

Competitors offered on-demand models with reduced service quality, prioritising higher CLV over MRR growth.

Market Opportunity

Unmet demand for flexible, high-quality vulnerability management among smaller organisations.

Recommendations

Pay-As-You-Go Tier

Transform the Essential tier to usage-based pricing for less mature customers, creating steady upsell pipeline while reducing churn.

Scan-Based Pricing ModelCharge by unique targets scanned per billing cycle rather than allocated target limits, accommodating variable estate sizes.

Freemium Transition

Replace time-bound free trials with freemium model, free regular monitoring with paid compliance deliverables to normalise continuous scanning value.

Value Education

Redesign user assessments to reinforce continuous monitoring, aligning customer understanding with industry best practices and our commercial model.

Proposed Validation Approach

To reduce implementation risk, I recommended a series of lightweight non-scaleable validation methods:

Pause vs. Cancel A/B test

Test retention psychology without functional changes

Pay-Per-Scan Pilot

Offer churning customers alternative pricing as proof of concept

Value-Price Interviews

Direct customer conversations on willingness to pay vs. feature expectations

These approaches would have provided concrete behavioural data to validate strategic recommendations with minimal resource commitment.

Business Impact

- Revenue Protection: Identified 80% of MRR at risk from product-market misalignment

- Strategic Pivot: Provided data-driven rationale for serving smaller customers alongside enterprise focus

- Pricing Strategy: Delivered framework for flexible pricing models matching customer usage patterns

- Competitive Positioning: Highlighted opportunity to capture market demand competitors were inadequately serving

Key Learnings

- Research drives strategy: User research can uncover critical business model insights beyond feature improvements

- Segmentation reveals truth: Customer behaviour patterns often contradict leadership assumptions about market priorities

- Value perception isn’t price sensitivity: "Nice to have" positioning indicates insufficient value delivery, not cost concerns

- Systems thinking scales impact: Connecting user behaviour to business model challenges creates organisational-level solutions

Organisational Impact & Learnings

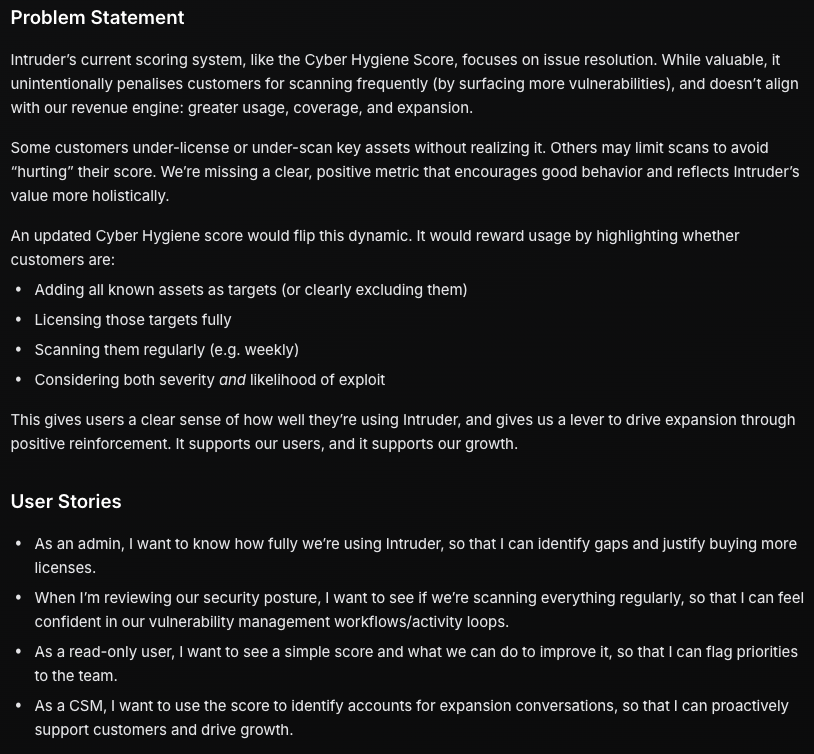

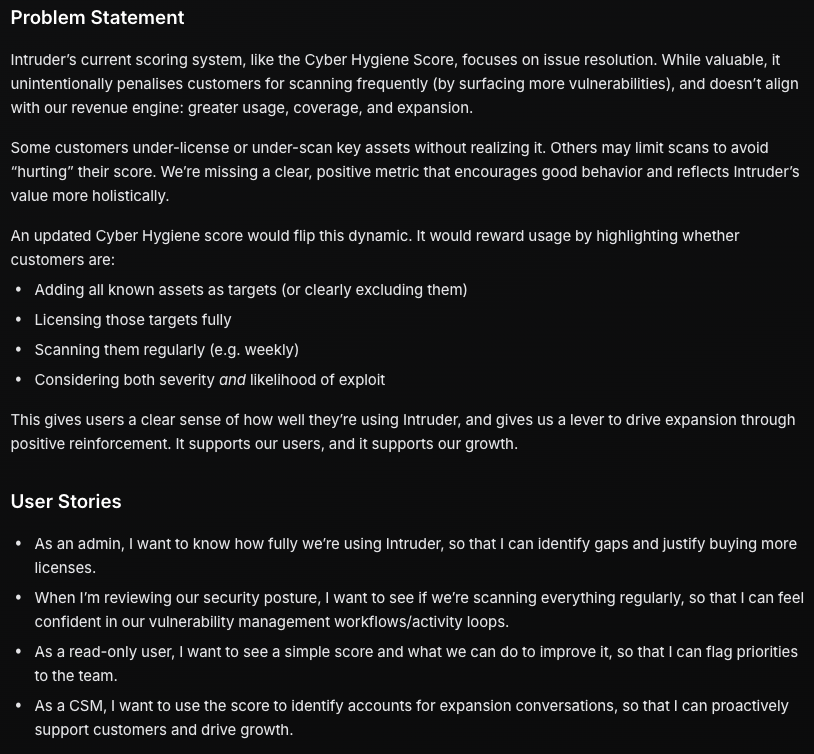

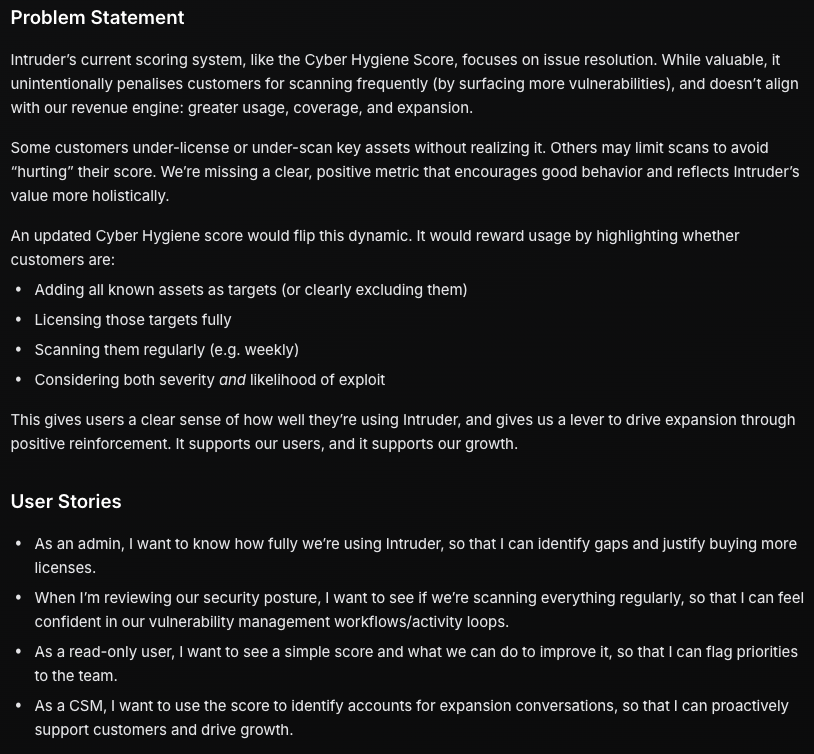

My research identified multiple strategic opportunities. While some required larger resource commitments, we immediately began addressing the assessment framework misalignment, a project I proposed, shaped and am currently leading.

While leadership ultimately prioritised large enterprise features over existing customer base growth, as part of a move up market, this analysis:

- Provided data-driven framework for future pricing strategy discussions

- Established foundation for customer-centric decision making

- Demonstrated the business case for balanced growth strategies (base + enterprise)

- Highlighted the strategic value of research in challenging organisational assumptions

The experience reinforced my belief that sustainable growth comes from understanding and serving your core customer base alongside enterprise expansion, a philosophy that drives my approach to product strategy.

This research made the case for us to overhaul how we assess customers, successfully arguing for it to be integrated to a much greater degree with both industry best practice and our revenue model.

Interested in discussing this project?

Reducing Churn Through Research Synthesis

Systems Thinking

Research Synthesis

Market Intelligence

Overview

Customer churn analysis revealed our platform was misaligned with actual user needs, we built for continuous monitoring while most departing customers wanted occasional scanning.

I ran conducted quantitative and qualitative research across our most popular subscription tiers, finding three critical friction points: a value perception gap, pricing model misalignment, and feature over-engineering for simpler use cases.

The research provided strategic recommendations for usage-based pricing and market segmentation opportunities that could reduce preventable churn and capture underserved customer segments.

Involvement

Project manager

~3 Weeks (Q2 ‘25)

Figjam, Count, Dovetail, Notion

Impact

>80%

Of MRR identified via Churn Surveys as a key threat to Intruder’s annual strategic goals.

Aligned pricing with customer behaviour

Key recommendations were framed to tie customer behaviour back into the revenue model.

Repeatable Models

Established to link user research to business outcomes, embedding customer-centric thinking at the leadership level of the organisation.

Challenge

Intruder's churn rates exceeded industry benchmarks despite leadership focus on larger enterprise contracts. Our core customer base, smaller organisations representing ~80% of monthly recurring revenue, was leaving at concerning rates. Previous attempts to address churn through plan iteration hadn't worked.

Exit survey feedback suggested fundamental misalignment between our continuous monitoring product and actual customer needs.

Approach

As Product Design Manager, I scoped and led an end-to-end churn analysis initiative combining:

Research Methods

- Exit and product-market fit surveys

- JTBD and User Interviews Conducted

- Usage data analysis across Pro, Cloud, and Essential tiers

- Competitive landscape analysis

- Customer segmentation by lifespan, company size, target count, and vulnerabilities detected

Analysis Framework

Grouped qualitative feedback into behavioural themes, then translated findings into strategic business recommendations for leadership.

As part of the review we did a range of JTBD interviews with new customers who were relatively early in the customer lifecycle.

Key Findings

Product-Market Misalignment

~75% of those who filled in the required churn survey gave reasons like the following:

“The value was good especially compared to other typical third-party scanners that just put a human in the loop to send you a Nessus report and charge twice as much as you do. However I don't have need for continuous scanning at this moment.”

Kevin, Essential Tier Customer

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

“The 30 day delay for reassigning licences is really painful when updating a device. Particularly if a device has not been active for >30 days.”

Adrian, Pro Tier Customer

Fixed subscriptions didn't match variable usage patterns, creating administrative burden and perceived inflexibility.

Strategic Insights

Critical Business Risk

The segment experiencing these issues represented ~80% of MRR, massive opportunity cost from focusing exclusively on enterprise while neglecting core revenue base.

Competitive Context

Competitors offered on-demand models with reduced service quality, prioritising higher CLV over MRR growth.

Market Opportunity

Unmet demand for flexible, high-quality vulnerability management among smaller organisations.

Recommendations

Pay-As-You-Go Tier

Transform the Essential tier to usage-based pricing for less mature customers, creating steady upsell pipeline while reducing churn.

Scan-Based Pricing ModelCharge by unique targets scanned per billing cycle rather than allocated target limits, accommodating variable estate sizes.

Freemium Transition

Replace time-bound free trials with freemium model, free regular monitoring with paid compliance deliverables to normalise continuous scanning value.

Value Education

Redesign user assessments to reinforce continuous monitoring, aligning customer understanding with industry best practices and our commercial model.

Proposed Validation Approach

To reduce implementation risk, I recommended a series of lightweight non-scaleable validation methods:

Pause vs. Cancel A/B test

Test retention psychology without functional changes

Pay-Per-Scan Pilot

Offer churning customers alternative pricing as proof of concept

Value-Price Interviews

Direct customer conversations on willingness to pay vs. feature expectations

These approaches would have provided concrete behavioural data to validate strategic recommendations with minimal resource commitment.

Business Impact

- Revenue Protection: Identified 80% of MRR at risk from product-market misalignment

- Strategic Pivot: Provided data-driven rationale for serving smaller customers alongside enterprise focus

- Pricing Strategy: Delivered framework for flexible pricing models matching customer usage patterns

- Competitive Positioning: Highlighted opportunity to capture market demand competitors were inadequately serving

Key Learnings

- Research drives strategy: User research can uncover critical business model insights beyond feature improvements

- Segmentation reveals truth: Customer behaviour patterns often contradict leadership assumptions about market priorities

- Value perception isn’t price sensitivity: "Nice to have" positioning indicates insufficient value delivery, not cost concerns

- Systems thinking scales impact: Connecting user behaviour to business model challenges creates organisational-level solutions

Organisational Impact & Learnings

My research identified multiple strategic opportunities. While some required larger resource commitments, we immediately began addressing the assessment framework misalignment, a project I proposed, shaped and am currently leading.

While leadership ultimately prioritised large enterprise features over existing customer base growth, as part of a move up market, this analysis:

- Provided data-driven framework for future pricing strategy discussions

- Established foundation for customer-centric decision making

- Demonstrated the business case for balanced growth strategies (base + enterprise)

- Highlighted the strategic value of research in challenging organisational assumptions

The experience reinforced my belief that sustainable growth comes from understanding and serving your core customer base alongside enterprise expansion, a philosophy that drives my approach to product strategy.

This research made the case for us to overhaul how we assess customers, successfully arguing for it to be integrated to a much greater degree with both industry best practice and our revenue model.

Interested in discussing this project?

Reducing Churn Through Research Synthesis

Systems Thinking

Research Synthesis

Market Intelligence

Overview

Customer churn analysis revealed our platform was misaligned with actual user needs, we built for continuous monitoring while most departing customers wanted occasional scanning.

I ran quantitative and qualitative research across our most popular subscription tiers, finding three critical friction points: a value perception gap, pricing model misalignment, and feature over-engineering for simpler use cases.

The research provided strategic recommendations for usage-based pricing and market segmentation opportunities that could reduce preventable churn and capture underserved customer segments.

Involvement

Lead researcher

~3 Weeks (Q2 ‘25)

Figjam, Count, Dovetail, Notion

Impact

>80%

Of MRR identified via Churn Surveys as a key threat to Intruder’s annual strategic goals.

Aligned pricing with customer behaviour

Key recommendations were framed to tie customer behaviour back into the revenue model.

Repeatable Models

Established to link user research to business outcomes, embedding customer-centric thinking at the leadership level of the organisation.

Challenge

Intruder's churn rates exceeded industry benchmarks despite leadership focus on larger enterprise contracts. Our core customer base, smaller organisations representing ~80% of monthly recurring revenue, was leaving at concerning rates. Previous attempts to address churn through plan iteration hadn't worked.

Exit survey feedback suggested fundamental misalignment between our continuous monitoring product and actual customer needs.

Approach

As Product Design Manager, I scoped and led an end-to-end churn analysis initiative combining:

Research Methods

- Exit and product-market fit surveys

- JTBD and User Interviews Conducted

- Usage data analysis across Pro, Cloud, and Essential tiers

- Competitive landscape analysis

- Customer segmentation by lifespan, company size, target count, and vulnerabilities detected

Analysis Framework

Grouped qualitative feedback into behavioural themes, then translated findings into strategic business recommendations for leadership.

As part of the review we did a range of JTBD interviews with new customers who were relatively early in the customer lifecycle.

Key Findings

Product-Market Misalignment

~75% of those who filled in the required churn survey gave reasons like the following:

“The value was good especially compared to other typical third-party scanners that just put a human in the loop to send you a Nessus report and charge twice as much as you do. However I don't have need for continuous scanning at this moment.”

Kevin, Essential Tier Customer

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

Value Perception Gap: Smaller customers viewed the service as "nice to have" rather than essential, indicating insufficient value delivery, rather than a superficial pricing sensitivity.

Pricing Model Friction

“The 30 day delay for reassigning licences is really painful when updating a device. Particularly if a device has not been active for >30 days.”

Adrian, Pro Tier Customer

Fixed subscriptions didn't match variable usage patterns, creating administrative burden and perceived inflexibility.

Strategic Insights

Critical Business Risk

The segment experiencing these issues represented ~80% of MRR, massive opportunity cost from focusing exclusively on enterprise while neglecting core revenue base.

Competitive Context

Competitors offered on-demand models with reduced service quality, prioritising higher CLV over MRR growth.

Market Opportunity

Unmet demand for flexible, high-quality vulnerability management among smaller organisations.

Recommendations

Pay-As-You-Go Tier

Transform the Essential tier to usage-based pricing for less mature customers, creating steady upsell pipeline while reducing churn.

Scan-Based Pricing ModelCharge by unique targets scanned per billing cycle rather than allocated target limits, accommodating variable estate sizes.

Freemium Transition

Replace time-bound free trials with freemium model, free regular monitoring with paid compliance deliverables to normalise continuous scanning value.

Value Education

Redesign user assessments to reinforce continuous monitoring, aligning customer understanding with industry best practices and our commercial model.

Proposed Validation Approach

To reduce implementation risk, I recommended a series of lightweight non-scaleable validation methods:

Pause vs. Cancel A/B test

Test retention psychology without functional changes

Pay-Per-Scan Pilot

Offer churning customers alternative pricing as proof of concept

Value-Price Interviews

Direct customer conversations on willingness to pay vs. feature expectations

These approaches would have provided concrete behavioural data to validate strategic recommendations with minimal resource commitment.

Business Impact

- Revenue Protection: Identified 80% of MRR at risk from product-market misalignment

- Strategic Pivot: Provided data-driven rationale for serving smaller customers alongside enterprise focus

- Pricing Strategy: Delivered framework for flexible pricing models matching customer usage patterns

- Competitive Positioning: Highlighted opportunity to capture market demand competitors were inadequately serving

Key Learnings

- Research drives strategy: User research can uncover critical business model insights beyond feature improvements

- Segmentation reveals truth: Customer behaviour patterns often contradict leadership assumptions about market priorities

- Value perception isn’t price sensitivity: "Nice to have" positioning indicates insufficient value delivery, not cost concerns

- Systems thinking scales impact: Connecting user behaviour to business model challenges creates organisational-level solutions

Organisational Impact & Learnings

My research identified multiple strategic opportunities. While some required larger resource commitments, we immediately began addressing the assessment framework misalignment, a project I proposed, shaped and am currently leading.

While leadership ultimately prioritised large enterprise features over existing customer base growth, as part of a move up market, this analysis:

- Provided data-driven framework for future pricing strategy discussions

- Established foundation for customer-centric decision making

- Demonstrated the business case for balanced growth strategies (base + enterprise)

- Highlighted the strategic value of research in challenging organisational assumptions

The experience reinforced my belief that sustainable growth comes from understanding and serving your core customer base alongside enterprise expansion, a philosophy that drives my approach to product strategy.

This research made the case for us to overhaul how we assess customers, successfully arguing for it to be integrated to a much greater degree with both industry best practice and our revenue model.

Interested in discussing this project?